The A-Z of Ethereum Forks: From the DAO Hack to Ethereum Classic and Beyond

A series exploring Ethereum, it's history, future and relation to the wider crypto ecosystemEthereum Forks

In the world of cryptocurrencies, the term “fork” is often thrown around. But what does it mean, and how does it apply to Ethereum? In this comprehensive guide, we will explore the different Ethereum forks, including the infamous DAO hack and split between Ethereum vs Ethereum Classic.

Ethereum forks and the creation of new blockchains like Ethereum Classic, Ethereum Fair and EthereumPoW

We will delve into the motivations behind each fork, their impact on the Ethereum ecosystem, and potential future Ethereum forks.

This article is part of the below series on Ethereum:

- The Rise of Ethereum: A Comprehensive Guide to the World’s Second-Largest Cryptocurrency

- A Timeline & History of Ethereum: From Inception to Ethereum 2.0

- What Is Ethereum in Basic Terms & How Does It Relate to the Wider Crypto Ecosystem

- The A-Z of Ethereum Forks: From the DAO Hack to Ethereum Classic and Beyond

- Ethereum vs Bitcoin: A Comparative Analysis of the Top Two Cryptocurrencies

- Understanding Ethereum’s Smart Contracts and Decentralized Applications (DApps)

- Exploring the Use Cases and Real-World Applications of Ethereum

- The Beacon Chain and The Merge: Ethereum’s Roadmap to Proof-of-Stake

- The Future of Ethereum: An In-Depth Look at Ethereum 2.0 and Beyond

What Is a Fork in Crypto?

A fork, in the context of crypto and blockchain technology, is a change to the existing codebase that results in a divergence from the original blockchain. There are two types of forks: hard forks and soft forks. In its most simple terms, a hard fork creates a new, incompatible blockchain, while a soft fork is a backwards-compatible change that doesn’t create a new blockchain.

For more information about forks in crypto, read on.

What is a soft fork?

A soft fork is a change to the blockchain protocol in which only previously valid blocks/transactions are made invalid.

This type of fork requires only a majority of the miners to upgrade to enforce the new rules, as opposed to a hard fork which requires (almost) all nodes to upgrade and agree on the new version. Soft forks are backwards-compatible by nature, as the old nodes will recognise new blocks as valid.

This means that users do not need to upgrade their software for the new rules to be enforced. The defining characteristic of a soft fork is that its backwards compatibility ensures that older versions of the software can still process transactions and push new blocks to the blockchain.

What is a hard fork?

A hard fork is a change to the blockchain protocol that makes previously invalid blocks/transactions valid (or vice-versa).

This requires all nodes or users to upgrade to the latest version of the blockchain protocol software. A hard fork is a permanent divergence from the previous version of the blockchain, and nodes running previous versions will no longer be accepted by the newest version.

This essentially creates a fork in the blockchain: one path follows the new, upgraded blockchain, and the other path continues along the old path. The most significant characteristic of a hard fork is that older versions of the software will be incompatible with the new network, potentially resulting in a separate coin being created.

What other famous forks have happened outside of Ethereum?

Quite possibly the most famous hard fork is the DAO hack in 2016, which resulted in both Ethereum and Ethereum Classic.

However, there have been other notable instances of both hard forks and soft forks in the Bitcoin blockchain, which are explained below:

- Pay to Script Hash (P2SH – Soft Fork): In 2012, the Bitcoin network implemented a soft fork to introduce a feature called “Pay to Script Hash” (P2SH), which added more functionality to Bitcoin transactions. This change was made to allow transactions to be sent to a script hash (address starting with 3 in Bitcoin) instead of a public key hash (addresses starting with 1). Transactions sent to a P2SH address can be spent by anyone who can provide a script (or a set of signatures), matching the script hash. This feature was backwards-compatible, meaning that nodes running the older version of the Bitcoin protocol software would still be able to validate transactions and add new blocks to the blockchain.

- Bitcoin XT (Hard Fork): In 2015, Bitcoin XT, a new client, was launched that aimed to increase the block size from 1MB to 8MB. The idea behind Bitcoin XT was to allow for more transactions per second, thereby increasing the speed of the Bitcoin network. However, because this change was not backwards-compatible, it was a hard fork. In this case, the community did not widely adopt Bitcoin XT, and it did not replace the existing version of Bitcoin. Bitcoin XT was largely considered a failure as it did not receive enough support from the community to reach the needed threshold to replace the original Bitcoin client.

- Bitcoin Cash (Hard Fork): Bitcoin Cash is another notable hard fork that occurred in 2017, a year after the Ethereum DAO fork. It was created to increase the block size from 1MB to 8MB to allow for more transactions to be processed in each block, thereby increasing the overall transaction speed of the network.

- Segregated Witness (SegWit) Upgrade (July 2017): This is one of the most well-known Bitcoin soft forks. The upgrade split up signature data into a separate memory cache. Nodes could transact data into a block stored in the computer’s RAM. This allowed more transactions to fit into a block, without breaking any previous rules. The upgrade also introduced a new address type (Bech32). Full nodes using older P2SH Bitcoin addresses could still transact with Bech32 Bitcoin addresses.

For both of the hard forks illustrated above, the key difference lies in the compatibility with previous versions of the blockchain protocol software. In the case of the hard fork (Bitcoin XT), all nodes were required to upgrade to the new software to remain part of the network. In contrast, soft forks like P2SH allowed nodes to continue using the old software if they chose to do so, as it was backwards-compatible.

We’ll now discuss the DAO hack and how this hard fork resulted in a permanent divergence from the previous version of the Ethereum blockchain, resulting in two separate cryptocurrencies: Ethereum (ETH) and Ethereum Classic (ETC).

What is Ethereum Classic and The DAO Hack?

Ethereum Classic (ETC) was born out of a major event in Ethereum’s history: the DAO hack.

In 2016, a hacker exploited a vulnerability in the DAO (Decentralized Autonomous Organization), a decentralised investment fund built on the Ethereum blockchain, and stole millions of dollars worth of Ether (ETH).

To reverse the theft and restore the stolen funds, the Ethereum community decided to perform a hard fork, creating a new version of the blockchain. In what might seem like a strange decision, the new version continued as Ethereum (ETH) under the old ticker symbol, while the original, unforked blockchain became Ethereum Classic (ETC).

Ethereum vs Ethereum Classic

When discussing “Ethereum vs Ethereum Classic” or “ETH vs ETC“, it’s important to understand the origins and differences between these two cryptocurrencies, as summarised in the above section.

Ethereum (ETH) became the new chain, allowing for transactions to be altered and adjusted, which was the controversial decision that led to the split. Ethereum has since become the more popular of the two forks by a large margin, with a larger community, more developers, and higher market capitalisation.

On the other hand, Ethereum Classic, represented by the ticker symbol ETC, is the original blockchain that remained after the hard fork. ETC is committed to the principle of immutability, meaning that transactions on the blockchain cannot be altered or reversed. This commitment to the original code of Ethereum and the principle of immutability is a key ideological difference between ETC and ETH.

The decision to continue the new fork under the old ticker symbol ETH while the original blockchain became known by a new ticker symbol ETC has indeed caused some confusion. Many investors and users new to the crypto space may mistakenly believe that ETH is the original Ethereum blockchain due to its name and ticker symbol. However, in terms of the original code and blockchain, ETC holds that claim.

While Ethereum Classic may have been hard done by in terms of branding and recognition, it remains a significant part of the Ethereum story and continues to hold value for those who believe in the principle of immutability. Whether one views Ethereum or Ethereum Classic as winning the ETH vs ETC title to be the “true” Ethereum will depend largely on their perspective on issues like immutability and the ability to alter transactions.

The Role of Miners in the Ethereum Network

Miners have played a crucial role in the Ethereum network.

Prior to The Merge, both Ethereum and Ethereum Classic operated under the proof-of-work (PoW) consensus mechanism. This involved miners using either ASIC miners or GPU mining machines to validate and record transactions on the blockchain, ensuring its security and integrity. These miners competed to solve complex mathematical problems, and the first miner to find a solution is rewarded with the newly minted token (either ETH for Ethereum or ETC for Ethereum Classic).

largely due to the significant computational power and energy consumption required by PoW, Ethereum decided to transition to another consensus mechanism called proof-of-work (PoW), essentially replacing miners with validators. This was known as the Beacon Chain fork (or Ethereum 2.0 Phase 0), which happened in 2020.

Ethereum Classic continues to operate under the PoS mechanism with miners playing an integral part of the blockchain, something they consider to be integral to Ethereum’s original mission.

All Ethereum Forks: Frontier to Paris (The Merge)

Ethereum has experienced many forks throughout its history, each with its own motivations and implications.

Here is a full overview of the major forks:

| Date | Fork Name | Ticker Symbol | Market Sentiment | Description |

| July 30, 2015 | Frontier | ETH | Positive | The first live release of the Ethereum project. |

| September 7, 2015 | Frontier Thawing | ETH | Positive | Lifted the 5,000 gas limit per block and set the default gas price to 51 gwei. |

| March 14, 2016 | Homestead | ETH | Positive | The first production release of Ethereum, included several protocol changes and a networking change. |

| July 20, 2016 | DAO Fork | ETH | Mixed | Created in response to the DAO attack, moved the funds from the faulty contract to a new contract. |

| July 20, 2016 | Ethereum Classic | ETC | Mixed | A continuation of the original Ethereum blockchain – the classic version preserving untampered history. |

| October 18, 2016 | Tangerine Whistle | ETH | Positive | Addressed urgent network health issues concerning underpriced operation codes. |

| November 22, 2016 | Spurious Dragon | ETH | Positive | Addressed DoS attacks on the network, enabled “debloat” of the blockchain state, added replay attack protection. |

| October 16, 2017 | Byzantium | ETH | Positive | Included changes to contract complexity, memory, and adjustments to the balance between the two. |

| February 28, 2019 | Constantinople | ETH | Positive | Introduced efficiency improvements and made the transition to proof-of-stake easier. |

| December 8, 2019 | Istanbul | ETH | Positive | Optimized the gas cost of certain actions in the EVM, improved denial-of-service attack resilience. |

| January 2, 2020 | Muir Glacier | ETH | Positive | Introduced a delay to the difficulty bomb. |

| October 14, 2020 | Staking Deposit Contract | ETH | Positive | Introduced staking to the Ethereum ecosystem. |

| December 1, 2020 | Beacon Chain (Ethereum 2.0 Phase 0) | ETH | Positive | The Beacon Chain started producing blocks, an important first step in achieving the Ethereum vision. |

| April 15, 2021 | Berlin | ETH | Positive | Optimized the gas cost for certain EVM actions, and increases support for multiple transaction types. |

| August 5, 2021 | London | ETH | Positive | Introduced EIP-1559, which reformed the transaction fee market, along with changes to how gas refunds are handled and the Ice Age schedule. |

| September 15, 2022 | Paris (The Merge – Ethereum 2.0 Phase 1.5) | ETH | Positive | The Merge transition – its major feature was switching off the proof-of-work mining algorithm and associated consensus logic and switching on proof-of-stake instead. |

| Sep-22 | Ethereum Work | ETHW | Mixed | A potential fork of Ethereum 1.0 by a group of miners who did not migrate to POS. It is also known as Ethereum POW. |

| Sep-22 | Ethereum Fair | ETHF | Negative | Created on the 15th of September 2022, ETHF was not distributed to Ether holders, but to those who owned Bitcoin, Dogecoin, and Ethereum Classic. |

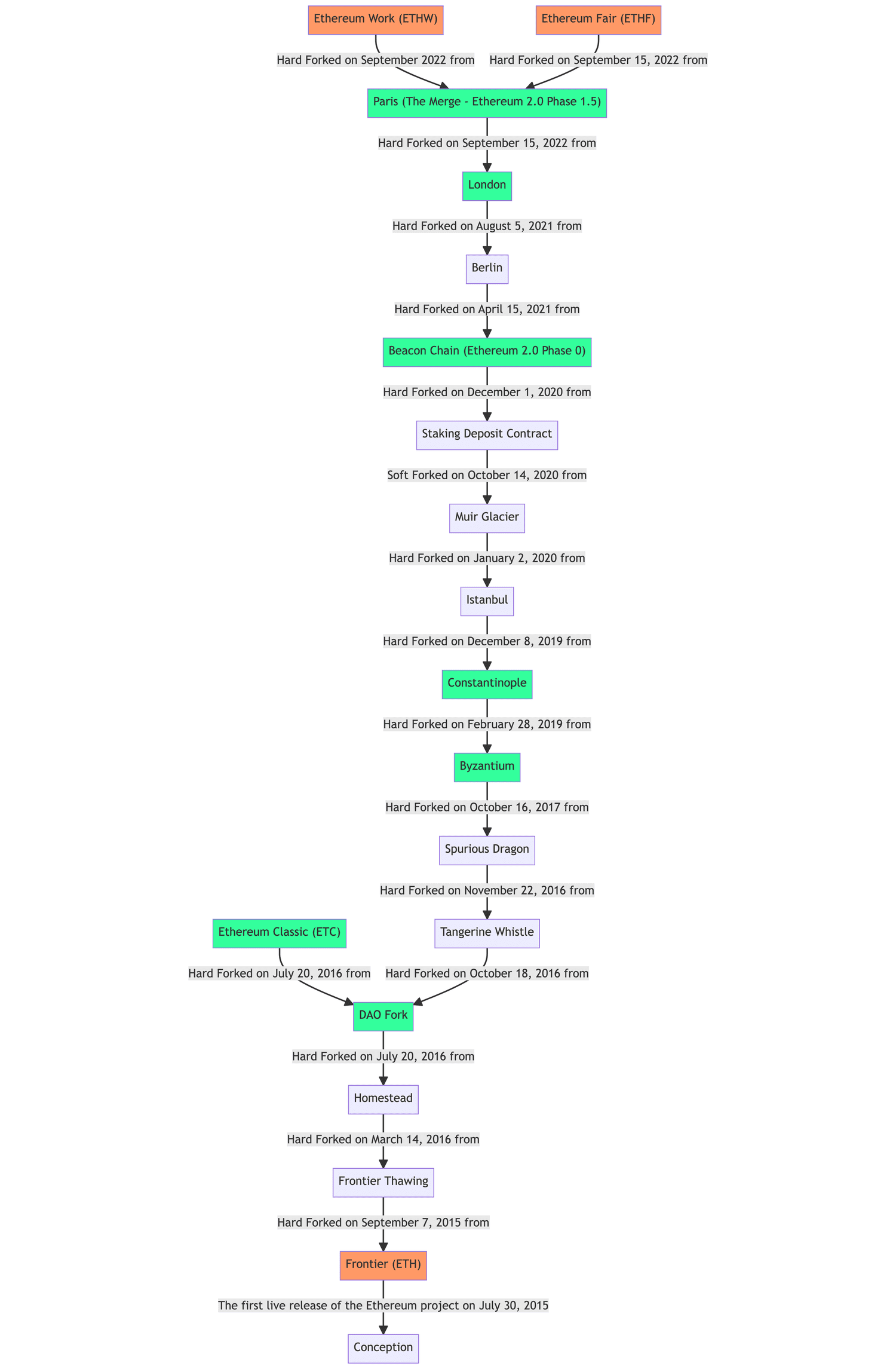

Ethereum Forks and Upgrades As a Flowc

All Ethereum forks and upgrades (illustrated as a flowchart)

What are Ethereum Upgrades? Are These the Same As Forks?

While Ethereum upgrades often involve changes to the blockchain’s protocol and functionality, they are not always accompanied by a fork.

Upgrades can be implemented through a soft fork, which maintains compatibility with the existing blockchain. However, some upgrades may require a hard fork to introduce significant changes that are not backwards-compatible.

Ethereum vs Cardano: Is Cardano an Ethereum Fork?

When exploring the question “Is Cardano an Ethereum Fork?” it’s important to note that Cardano is not a fork of Ethereum but a separate blockchain platform developed from scratch.

Cardano was developed independently of Ethereum. However, there is a connection between the two in the form of Charles Hoskinson, who is a co-founder of Ethereum and the founder of Cardano.

Cardano, like Ethereum, is a smart contract platform, but it differentiates itself through a research-driven approach to design. It uses a proof-of-stake consensus mechanism, which was in contrast to Ethereum’s initial proof-of-work mechanism. Unlike Ethereum, which uses an account-based model, Cardano is based on the “unspent transaction output” (UTXO) system.

It’s interesting to explore “Ethereum vs Cardano” as there is significant competition between the two projects. Ethereum has been a key part of decentralised finance and has a larger number of decentralised apps (dApps) running on it. However, Cardano claims to be more scalable, secure, and sustainable than Ethereum, thanks to its layered architecture and scientific approach to blockchain development. This has led to some confusion among users, with some mistakenly believing that Cardano is a fork of Ethereum due to the similarities in their visions and the shared history through Charles Hoskinson.

However, this is not the case. Cardano is not a fork of Ethereum. It is a separate blockchain platform with its own unique features and design philosophy.

The Latest ETH Forks: ETHF, ETHW & ETHS

In recent years, Ethereum has seen the emergence of new forks, including ETHF, ETHW, and also the emergence of ETHS.

When discussing “ETHF and ETHW”, it’s crucial to understand that these are both forks of the Ethereum blockchain, each with their unique vision, team, and technology.

ETHW, or EthereumPoW, is another hard fork of the original Ethereum blockchain network. It was the main Ethereum hard fork after The Merge. Some Ethereum miners decided to copy Ethereum’s Proof-of-Work blockchain and thus create ETHW. The fork was carried out in a bid to keep Ethereum in its original proof-of-work algorithm. Despite a rough start with significant price drops, ETHW is gaining adoption among top mining pools, indicating a potential future for this fork.

EthereumFair (ETHF) insists on maintaining the consensus algorithm of proof-of-work (PoW) after Ethereum switched to the proof-of-stake (PoS) model. The ETHF ecosystem is open to anyone without restrictions, and it aims to maintain fairness in the Ethereum ecosystem. It has gained a significant following, with a total of 2.1 million ETHF tokens having been burned as of the latest reports.

As for ETHS, it represents the token for the new PoS (proof-of-stake) Ethereum. It’s one of the potential fork tokens that were considered during the Ethereum Merge. However, as of now, there is not much detailed information available about ETHS.

Much like with Ethereum Classic (ETC), the role of miners is significant in these forks. Since both ETHF and ETHW maintain the PoW consensus algorithm, miners continue to play a crucial role in validating and adding new transactions to the blockchain.

All three Ethereum forks, ETC, ETHW and ETHF, are committed to maintaining the PoW consensus algorithm, which is likely to remain appealing to miners and those who believe in the original vision of Ethereum. However, the success of these forks will likely depend on factors such as community support, development activity, and market dynamics.

It’s also worth noting that these forks are not without controversy. Some members of the Ethereum community have expressed concerns about the potential for confusion and fragmentation caused by these forks. As always, we recommend that individuals conduct thorough research and exercise caution when considering investments in cryptocurrency forks.

Future Ethereum Forks

The possibility of future Ethereum forks remains uncertain. While forks can introduce new features, address vulnerabilities, or create alternative versions of the blockchain, they can also lead to fragmentation and community divisions.

As Ethereum continues to evolve with the transition to Ethereum 2.0, the need for forks may decrease as upgrades can be implemented through soft forks to implement any changes or enhancements needed.

Conclusion

Hopefully, you’ve enjoyed our comprehensive guide to Ethereum forks, including the DAO hack, The Merge, and how these significant events have led to rival forks and competing blockchains such as ETC, ETHW and ETHF.

These forks and updates have each played a significant role in the evolution of Ethereum, its use cases and applications. Each Ethereum fork has its own motivations and implications, shaping the Ethereum ecosystem and community. They’ll likely all continue to compete within the sphere of Ethereum for some time to come, but it seems unlikely any will emerge as a major contender and threat to Ethereum. Other related projects like Cardano on the other hand may pose more of a threat as they are not forks and have their own unique visions, technology and communities.

As Ethereum continues to innovate and upgrade, the possibility of future forks remains uncertain, but they will likely continue to be a part of Ethereum’s journey.

Please let us know if this article covering the rise of Ethereum forks has been helpful by leaving a comment or joining us on social media.

Last modified on: July 1, 2025

Latest Posts

GPU Mining, ASICs & Decentralisation Explained

IntroductionMining cryptocurrency has become a popular way to participate in the crypto and blockchain space while...

Basic Economics & Cryptocurrency Valuation

Why I've Written This Article? One of the most common, and most frustrating, objections (misconceptions) that I hear...

About CryptosRUs and Into the Cryptoverse

This post exploring CryptosRUs vs Into the Cryptoverse for free crypto advice is a little different to others we...

From Everyday People & General Adoption to the Bitcoin Elites: Who Will Benefit the Most?

IntroductionOn 6th September 2023, we published a massive article titled ‘Detailed Analysis of Projected Bitcoin...

Contact us to order your crypto mining rig today

Address

Opace Ltd t/a Crypto Mining Solutions, Park House, Bristol Rd South, Rubery, Birmingham, West Midlands, B45 9AH. UK

Phone

0845 017 7661